Real Estate News

Experts: 2024 Home Prices Won’t Decline

Despite predictions housing prices would come down, values keep rising in 2024. The reason? The tight inventory.

WASHINGTON – Much to the chagrin of would-be homebuyers, property prices just keep rising. It seems nothing — not even the highest mortgage rates in nearly 23 years — can stop the continued climb of home prices.

Prices increased once again in December, according to the National Association of Realtors (NAR), which reports that median existing-home prices were up 4.4% over last year — the sixth month in a row of year-over-year jumps. In another reflection of ongoing increases, the latest S&P CoreLogic Case-Shiller home price index showed a 4.8% jump in October that represented the ninth month in a row of gains.

So much for the idea that a “housing recession” would reverse some of the outsized price gains in homes. The U.S. housing market had finally started slowing in late 2022, and home prices seemed poised for a correction. But a strange thing happened on the way to the housing market crash: Home values started rising again.

NAR data shows that median sale prices of existing homes are near record highs. December 2023’s median of $382,600 is off the all-time-high of $413,800, but not by much, especially for a typically quiet time of year. (Seasonal fluctuations in home prices make June the highest priced month of most years — the all-time-high was reached in June 2022.) “The housing recession is essentially over,” says Lawrence Yun, NAR’s chief economist.

Home values held steady even as mortgage rates soared to 8% in October 2023, reaching their highest levels in more than 23 years. (They have since dipped back down, falling below 7% in recent weeks.) The main culprit is a lack of housing supply. Inventories remain frustratingly tight, with NAR’s December data showing only a 3.2-month supply.

"You’re not going to see house prices decline," says Rick Arvielo, head of mortgage firm New American Funding. "There’s just not enough inventory."

Skylar Olsen, chief economist at Zillow, agrees about the supply-and-demand imbalance. Her latest forecast says home prices will keep rising into 2024 — welcome news for sellers but not so great for first-time buyers struggling to become homeowners. “We’re not in that space where things are suddenly going to be more affordable,” Olsen says.

In fact, the trend is quite the opposite. According to Realtor.com’s December 2023 Housing Market Trends Report, high mortgage rates have increased the monthly cost of financing the typical home (after a 20% down payment) by 6.1% since last year. That equates to $123 more in monthly payments than a buyer last December would have seen.

Mortgage rates fell sharply in late December, a move that boosted affordability. However, lower mortgage rates also are pulling more buyers into the market. “The potential for a decline in mortgage rates intersects with the prime homebuying time of the year — if you can find one to buy, that is,” says Greg McBride, Bankrate’s chief financial analyst.

Taking all this into account, housing economists and analysts agree that any market correction is likely to be a modest one. No one expects price drops on the scale of the declines experienced during the Great Recession.

Is a crash coming? No. There are still more buyers than sellers, and that means a meaningful price decline can’t happen: “There’s just generally not enough supply,” says Mark Fleming, chief economist at title insurer First American Financial Corporation. “There are more people than housing inventory. It’s Econ 101.”

Dave Liniger, the founder of real estate brokerage RE/MAX, says the sharp rise in mortgage rates has skewed the market. Many would-be buyers have been waiting for rates to drop — but if mortgage rates do decline, it could send new buyers flooding into the market, pushing up home prices.

© Copyright 2024, Conley Publishing Group Ltd. All rights reserved.

New Home Sales Surge in December

Sales on new construction single-family homes increased 8% in December and 4.4% year over year across the U.S. In the South, new home sales increased by 5.2%.

WASHINGTON – Sales of newly built single-family homes surged in December, exceeding expectations fueled by lower mortgage rates and an inventory shortage.

New home purchases increased by 8.0% to a 664,000 seasonally adjusted annual rate after an upward revision to November’s figures, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The pace of new home sales in December is up 4.4% year to year.

An estimated 668,000 new homes were sold in 2023, up 4.2% from the 2022 figure of 641,000.

Regionally, on a year-to-year basis, new home sales are up in all four regions: up 3.5% in the Northeast, 3.6% in the Midwest, 5.2% in the South and 2.1% in the West.

“The solid new home sales rate in December was fueled by a lack of existing inventory in the resale market and declining interest rates,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a custom home builder from Birmingham, Ala. “The rise in sales also coincides with our latest builder surveys, which show a marked increase in future sales expectations because of falling mortgage rates.”

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the December reading of 664,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory in December remained elevated at a level of 453,000, up 0.4% compared to a year earlier. This represents an 8.2 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. Completed, ready-to-occupy inventory, 88,000 homes in December, is up 22.2% from a year ago. However, that inventory type remains just 19% of total inventory.

The median new home sale price in December was $413,200, edging down 3.0% from November, and down 13.8% compared to a year ago.

“New home sales ended the year on a high note thanks largely to falling interest rates and a decline in existing home sales,” said Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis. “And while moderating interest rates are a promising sign for new home sales in the year ahead, long-term issues such as a shortage of buildable lots, a lack of skilled labor and excessive regulations will continue to pose challenges for builders.”

© 2024 Florida Realtors®

Fannie Mae Sees Positive Home Price Growth Through 2025

Experts said the growth is encouraging for homebuyers but other factors, including AI and green energy, will play a role.

WASHINGTON – A panel of national

housing experts expect U.S. home prices to continue to grow through 2025, denoting “an encouraging consensus” as the new year ticks closer, a new Fannie Mae survey showed.

Fannie Mae’s Home Price Expectations Home Survey (HPES), conducted by Pulsenomics, found an annual national home price growth of 2.4% in 2024 and 2.7% in 2025. The HPES polls more than 100 experts across the housing and mortgage sectors and academia for forecasts of national home price percentage changes in each of the coming five calendar years, as measured by the Fannie Mae Home Price Index (FNM-HPI).

“Panel-wide, the average expected home price growth rate for 2023 jumped to 5.9%, which is a significant increase from the 3.3% level recorded in the previous survey conducted by Pulsenomics,” Terry Loebs, founder of Pulsenomics, said. “However, a large majority of the surveyed experts do not foresee this momentum carrying over into 2024 – an encouraging consensus for aspiring homebuyers as we approach the new year.”

Freddie Mac SVP and Chief Economist Doug Duncan shared insights into the survey’s findings:

“The survey panelists expect home price growth to decelerate in the coming years, following a 2023 price growth that proved more resilient than many anticipated. Some, including us, had expected the rapid and significant rise in mortgage rates in 2023 to have dampened purchase demand further than it has, putting more downward pressure on home prices this past year than what appears to have occurred. Looking beyond the recent volatility in mortgage rates, panelists expect future rates to decline meaningfully from the recent highs of 8 percent. This would obviously provide improved affordability for potential homebuyers, although anyone expecting the return of the extremely low rate environment from 2020 to 2022 will likely be disappointed. The panelists also revealed that they anticipate other factors will impact long-term interest rates, including demographic trends, expanding fiscal deficits, the evolution of artificial intelligence, and the green energy transition.”

© 2023 Florida Realtors®

New Home Sales Weaken in October

Sales were down 5.6% month-to-month, but they’re up 17.7% year-to-year and up 4.6% so far in 2023. About 30% of all Oct. home sales were new construction.

WASHINGTON – Sales of newly built, single-family homes in October fell 5.6% compared to September, to a 679,000 seasonally adjusted annual rate, after “a notable downward revision in September.”

However, the pace of new home sales in October was up 17.7% year-to-year, according to the monthly data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

According to the National Association of Home Builders (NAHB), higher mortgage rates that averaged 7.62% per Freddie Mac, the highest rate since 2000, depressed buyer demand and pushed down October’s sales.

NAHB Chairman Alicia Huey, noting the interest rates, says new-home sales are not only up year-to-year, they’re also up 4.6% in 2023 so far “due to a lack of inventory in the resale market.”

“Median new home prices have moved lower as new home size has decreased in 2023,” says NAHB Chief Economist Robert Dietz. “Combined with sales incentives and a lack of resale inventory, demand has remained solid in 2023 and should improve in 2024 as interest rates move lower.”

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the October reading of 679,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory in October increased to the highest level since January, up 8.3% from the previous month, to 439,000 – a 7.8-month supply at the current building pace. A measure near a 6-month supply is considered balanced.

Of total inventory available to buyers, which includes new and existing homes, newly-built homes made up 30% of all single-family homes available for sale in October. Historically, new homes make up only 12%.

The median new-home sale price in October was $409,300, down 3.1% from September, and down 17.6% year-to-year. Part of that drop is due to builder incentive use, though some stems from a trend to build smaller homes.

According to NAHB, 33% of October sales were priced between $300,000 and $400,000; a year earlier, only 20% of sales were in that range.

Regionally, on a year-to-date basis, new home sales were up 9.5% in the Northeast, 5.8% in the South and 2.5% in the West. In the Midwest, however, sales were down 0.3%.

© 2023 Florida Realtors®

5 Fla. Metros Still Top U.S. Move-To Hotspots

A Texas hotspot (Austin) lost residents for the first time, while Orlando, North Port-Sarasota, Tampa, Cape Coral and Miami made the top 10 for incoming residents.

SEATTLE – About one-quarter (25.9%) of homebuyers looked to different part of the country in the third quarter of 2023, essentially flat from the record high of 26% in August. It’s up a bit from 24% a year ago and 19% before the pandemic. That data is based on about two million home searches conducted through Redfin’s website and covers more than 100 U.S. metro areas from July 2023 through September 2023.

Overall, Florida’s metro areas remain strongly desired by buyers looking outside their current state, with five of the nation’s top 10 go-to metros. While overall demand has dropped some since the early days of the pandemic and work-from-home changes, the state continues to attract new residents, unlike some pandemic hotspots that have seen demand drop. Redfin’s latest report, for example, notes that once-hot Austin, Texas, has seen more residents planning to move out than in.

Top 10 U.S. go-to metros areas in 3Q 2023

- Sacramento, Calif. – 4,800 new residents; top out-of-state origin: Chicago

- Las Vegas – 4,500 new residents; top out-of-state origin: Los Angeles

- Orlando – 4,000 new residents; top out-of-state origin: New York City

- Myrtle Beach, S.C. – 3,800 new residents; top out-of-state origin: Washington, D.C.

- North Port-Sarasota – 3,700 new residents; top out-of-state origin: New York City

- Portland, Maine – 3,500 new residents; top out-of-state origin: Boston

- Tampa – 3,400 new residents; top out-of-state origin: New York City

- Cape Coral – 3,300 new residents; top out-of-state origin: Chicago

- Miami – 3,200 new residents; top out-of-state origin: New York City

- Salisbury, Maryland – 3,100 new residents; top out-of-state origin: Washington, D.C.

The drop in numbers for people considering out-of-state moves is less than the overall number of homebuyers seeking a move because affordability is a driving reason to relocate for many of them.

Austin, Texas, had a notable fall. At the start of 2021, it was the top move-to metro in the nation, and the reasons for its decline may hold lessons for other metro areas. According to the study, Austin’s decline stems from a few issues:

- Rising home prices. By mid-2022, Austin prices were up more than 75% from before the pandemic. The gap between Austin home prices and those of its feeder states, such as Los Angeles and San Francisco, is smaller than it used to be.

- Monthly mortgage payments doubled. A typical monthly payment for Austin’s median-priced home ($455,000) at a 7.63% mortgage rate is $3,890, nearly double 2019’s typical payment of $2,136.

- Return-to-work policies: Some formerly remote workers moved back to their home city; others moved back after realizing Austin isn’t a good long-term fit; still others moved to major job hubs as the labor market started slowing.

Homebuyers leaving Austin are most commonly moving to other places in Texas. San Antonio and Corpus Christi are two of the three most popular destinations for Redfin.com users moving away from Austin; the other is Denver.

© 2023 Florida Realtors®

Single-Family Starts Up a Surprising 7% in Sept.

Frustrated with the lack of existing-home inventory, more buyers turned to new construction in Sept. despite mortgage rates that topped 7%.

WASHINGTON – Despite elevated mortgage rates averaging above 7%, single-family starts posted a solid gain in September as more buyers turned to builders after facing a dearth of inventory in the resale market.

Overall housing starts increased 7% in September to a seasonally adjusted annual rate of 1.36 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. The September reading is the number of housing units builders would begin if development kept the same pace for 12 months.

Within the overall number, single-family starts increased 3.2% to a 963,000 seasonally adjusted annual rate. For all of 2023, however, single-family starts are still lower year-to-year, down 12.8%.

The multifamily sector, which includes apartment buildings and condos, increased 17.6% to an annualized 395,000 pace.

Alicia Huey, chairman of the National Association of Home Builders (NAHB), calls the 7.6% uptick “somewhat unexpected … Our latest builder surveys indicate that starts are likely to weaken in the months ahead due to recent higher mortgage rates.”

“Despite ongoing challenges in the market, the housing deficit of resale inventory continues to provide some market support for builders,” says NAHB Chief Economist Robert Dietz. “Because of a lack of existing homes in the marketplace, 31% of homes available for sale in August were new construction. This compares with a historical average in the 12-14% range. But in another sign that higher interest rates have slowed the market, the number of single-family homes under construction in September was 674,000, which is almost 15% lower than a year ago.”

On a regional and year-to-date basis, combined single-family and multifamily starts are 23.3% lower in the Northeast, 12.9% lower in the Midwest, 7.8% lower in the South and 16.9% lower in the West.

Overall permits – a sign of future home-start activity – decreased 4.4% to a 1.47 million unit annualized rate in September, though single-family permits increased 1.8% and multifamily permits decreased 14.3%.

Looking at regional permit data on a year-to-date basis, permits are 22.3% lower in the Northeast, 16.6% lower in the Midwest, 12.7% lower in the South and 17.6% lower in the West.

© 2023 Florida Realtors®

Fla. Sept. Report: Single-Family Sales Up 6.1%

The increase breaks a pattern of declines, says Florida Realtors Chief Economist O’Connor, as prices rose 1.3%. For 3Q 2023, though, sales were down 3.2%.

ORLANDO, Fla. – In September and the third quarter (3Q) of 2023, Florida’s housing market continued to show signs of stabilization in statewide median prices and improving inventory levels (active listings) compared to a year ago, according to Florida Realtors®’ latest housing data.

“Florida continues to draw new residents, and the dollar volume of single-family home sales in September was up 14.1% year-over-year to $12.2 billion dollars,” says 2023 Florida Realtors® President G. Mike McGraw, a broker-associate with LPT Realty in Orlando. “Over that same timeframe, closed sales of single-family homes rose 6.1%. The Florida market remains strong in the face of higher mortgage rates, and first-time buyers are finding greater selections and less competition than they’ve seen in years.”

September 2023: Last month, closed sales of existing single-family homes statewide totaled 21,335, up 6.1% year-over-year; existing condo-townhouse sales totaled 8,387, down 0.2% over September 2022, according to data from Florida Realtors Research Department in partnership with local Realtor boards/associations.

3Q 2023: Statewide existing single-family home sales totaled 66,450 for 3Q, down 3.2% from 3Q 2022. Statewide existing condo-townhouse sales totaled 26,129, down 5.8% year-over-year. Closed sales may occur from 30- to 90-plus days after sales contracts are written.

Florida Realtors Chief Economist Dr. Brad O’Connor sees some increasingly positive signs as the market enters the fall season.

“In September, closed sales of single-family homes were up for the first time compared to a year ago, rising by over 6%,” says O’Connor. “Closed sales of townhouses and condos in 2023 have been converging with their 2022 levels as well. We were still down in September year over year, but by a fraction of 1%.”

While higher mortgage rates continue to challenge buyers, they’ve been rising “at a much slower pace than last year,” O’Connor adds.

In September, the statewide median sales price for single-family existing homes was $409,243, up 1.3% from $403,880 one year earlier. For condo-townhouse units, the median price was $324,990, up 5.8% from $307,250 recorded in September 2022.

In 3Q 2023, Florida’s single-family median sales price was $414,000, a 1.0% increase over the second quarter of 2022. The 3Q condo-townhouse median sales price was $320,545, a 5.8% year-over-year increase. The median is the midpoint; half the homes sold for more, half for less.

“So far in 2023, new listings have been at their lowest level in several years, but in recent months, the level of new listings has been a little closer to pre-pandemic levels than it was earlier in the year,” says O’Connor. “In fact, new single-family listings in September exceeded the number of new listings in the same month in 2019 (pre-pandemic) for the first time this year. The same is also true if we compare this September’s new listings to those of last year, amounting to a year-over-year increase of 8%.”

The end result, O’Connor says, is more active inventory at the end of September than at the beginning, and a slightly higher inventory of single-family homes year over year. However, he added, “Florida is still pretty far below the pre-pandemic level of inventory at this time in 2019.”

On the supply side of the market, Florida had a 3.2-month supply of single-family existing homes in September, a 28% year-over-year increase. For condo-townhouse units, the state had a 4.1-month supply in September, for a 78.3% year-over-year increase.

To see the full statewide housing activity reports, go to the Florida Realtors Newsroom and look under Latest Releases or download the September 2023 and 3Q 2023 data report PDFs under Market Data.

© 2023 Florida Realtors®

The Rough Buyers Market Still Great for Sellers

Years of soaring prices and a limited inventory of for-sale homes has stressed buyers for years, but today’s market remains a profit goldmine for most sellers.

LOS ANGELES (AP) – Despite a housing slump going back more than a year, soaring home prices in recent years and a stubborn shortage of properties on the market are helping to drive solid profit gains for sellers.

The profit margin on median-priced single-family homes and condos nationally soared to 59% in the July-September quarter, according to a report released Thursday by real estate information provider Attom. The profit margin in a home sale represents the percent difference between the original purchase price and what it was sold for.

“Prices and profits around the U.S. got another boost over the summer as the housing market continued recovering from last year’s setbacks,” said Attom CEO Rob Barber.

The third quarter increase followed profit margin gains of 56.6% in the April-June period and 55.2% in the January-March quarter.

Even so, home sellers in the third quarter didn’t fare as well as in the same quarter last year, when the profit margin on a median-priced home was 62%, just below the all-time high on records going back to 2008.

Home prices have remained resilient even as the housing market has slowed sharply under the weight of surging mortgage rates, which have held above 7% since August, crushing homebuyers’ purchasing power.

The sharply higher home loan borrowing costs have discouraged many homeowners who locked in rates around 3% just two years ago from selling now, limiting the already near historic-low level of homes on the market. That, in turn, has stoked competition for fewer homes, keeping prices from falling significantly.

The nationwide median home price rose 2% in the third quarter to an all-time high $350,000, according to Attom’s data.

By some measures, home prices soared more than 40% during the pandemic as mortgage rates hit rock bottom, expanding how much homebuyers could afford to borrow. That led to bidding wars and homebuyers paying sometimes hundreds of thousands of dollars above the seller’s asking price.

Many homeowners who bought their home before this superheated period in the market, are in the position to potentially reap a hefty profit margin should they sell now. And the longer they owned their home, the more the potential profit margin.

Homeowners who sold in the third quarter had owned their homes an average of 7.86 years, which marked the second highest point since 2000, according to Attom.

Still, when looking only at seller gross profits – not the profit margin – their gains are bit more modest. The median U.S. home sale gross profit in the third quarter was $129,900, a 3.2% gain compared to the same quarter last year and a 5% improvement since the second quarter, Attom found.

Copyright 2023 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

NAR: June Pending Sales Rose 0.3%

“The recovery has not taken place, but the housing recession is over,” says NAR’s chief economist, after the first pending-sales increase in three months.

WASHINGTON – Pending home sales registered a modest increase of 0.3% in June month-to-month – its first increase since February – according to the National Association of Realtors® (NAR). The South and West posted monthly losses, while sales in the Northeast and Midwest grew. All four U.S. regions saw year-over-year transaction declines.

“The recovery has not taken place, but the housing recession is over,” says NAR Chief Economist Lawrence Yun, “The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply. Homebuilders are ramping up production and hiring workers.”

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – rose 0.3% to 76.8 in May. Year over year, pending transactions fell by 15.6%. An index of 100 is equal to the level of contract activity in 2001.

Forecasting the future

NAR predicts the 30-year fixed mortgage rate will hit 6.4% before the end of this year and then decline a bit in 2024, dropping to 6.0%. It believes the unemployment rate will rise slightly to 3.7% this year and then increase to 4.1% in 2024.

“With consumer price inflation calming close to the Federal Reserve’s desired conditions, mortgage rates look to have topped out,” Yun says. “Given the ongoing job additions, any meaningful decline in mortgage rates could lead to a rush of buyers later in the year and into the next.”

NAR expects:

- Existing-home sales to decrease 12.9% from 2022 to 2023 and settle at 4.38 million, before climbing 15.5% to 5.06 million in 2024.

- National median existing-home prices will remain steady, declining 0.4% to $384,900 before rebounding by 2.6% to $395,000 in 2024.

- The West – the country’s most expensive region – will see reduced prices, while the more affordable Midwest region is likely to see a small, positive increase.

- Housing starts will drop 5.3% from 2022 to 2023, to 1.47 million, before increasing to 1.55 million (5.4%) in 2024.

- Newly constructed home sales will increase from last year by 12.3% in 2023, to 720,000, due to additional inventory. And it will increase by another 13.9% in 2024, to 820,000.

- The national median new home price will decrease by 1.9% this year to $449,100, and then improve by 4.2% next year, to $468,000.

“It is critical to expand supply as much as possible to widen access to homebuying for more Americans,” Yun says. “Home prices will be influenced by how much inventory is brought to market. Increased homebuilding will tame price growth, while limited construction will lead to home price appreciation outpacing income growth.”

Pending home sales regional breakdown:

- The Northeast PHSI rose 0.6% from last month to 67.1, a decrease of 16.7% from June 2022.

- The Midwest index jumped 4.3% to 77.6 in June, down 17.1% year-to-year.

- The South PHSI fell 1.4% to 93.3 in June, down 14.3% from the prior year.

- The West index fell 1.0% in June to 57.7, dipping 15.5% from May 2022

© 2023 Florida Realtors®

5 Fla. Metros in Top 10 for Out-of-State Buyers

In 2Q 2023, Fla. remained a top go-to state, with the lion’s share relocating from New York, but Chicago provided more buyers for Cape Coral, No. 7 on the list.

SEATTLE – A record one-in-four national homebuyers (25.5%) searched for homes in metros outside their current state in the in the second quarter, up from 23% one year earlier, according to a report from Redfin. Before the pandemic, it was 19%.

The total number of out-of-state-seeking buyers declined 7.5%, however the percentage grew because the number of people interested in in-state moves declined even more, down 18%.

Of the top 10 states eyed for residency, Florida metros made up 50% of the top 10 go-to state metros. Tampa ranked highest at No. 3, and Las Vegas moved into the top spot based largely on the number of Los Angeles residents looking for a new out-of-state city to call home.

Top 10 out-of-state metros in 2Q

- Las Vegas: Net inflow 5,700. Top origin: Los Angeles

- Phoenix: Net inflow 5,300. Top origin: Seattle

- Tampa: Net inflow 5,000. Top origin: New York City

- Orlando: Net inflow 4,900. Top origin: New York City

- Sacramento, Calif. Net inflow 4,800. Top origin: Chicago

- North Port-Sarasota: Net inflow 4,700. Top origin: New York City

- Cape Coral: Net inflow 4,100. Top origin: Chicago

- Dallas: Net inflow 4,100. Top origin: Los Angeles

- Miami: Net inflow 3,700. Top origin: New York City

- Houston: Net inflow 3,600. Top origin: New York City

Las Vegas topped Redfin’s list for the first time. The report notes that a typical Las Vegas home sells for $412,000, or less than half the price of a home in Los Angeles, and, “It’s a similar story for the other popular migration destinations, which include Phoenix, Sacramento and several Florida metros.”

Of the top 10, nine have lower median sale prices than the top origin metro of buyers moving in.

© 2023 Florida Realtors®

Lots of Fla. Cities ‘Best for First-Time Homebuyers’

What makes a city “best” for first-timers? WalletHub looked at 22 key indicators, such as attractiveness, affordability and quality of life. Top of the list? Palm Bay.

ORLANDO, Fla. – Not all first-time homebuyers are alike, and what they might find appealing can differ. But WalletHub looked at 300 U.S. cities and used “22 key indicators” to rank them. Those indicators include things like market attractiveness, affordability, quality of life, cost of living, real-estate taxes and property-crime rate.

Florida cities, both large and small, ranked near the top for first-time homebuyers.

Overall Florida metros in top 30 “Best Places for First-Time Homebuyers”

Florida large city rankings (out of 68 total)

1. Tampa: 64.44

2. Orlando: 63.08

10. Jacksonville: 56.88

28. Miami: 49.64

Florida midsize city rankings (out of 99 total)

1. Cape Coral: 65.07

2. Port St. Lucie: 63.36

11. Pembroke Pines: 57.52

15. St. Petersburg: 57.24

30. Tallahassee: 54.18

51. Hollywood: 49.95

53. Hialeah: 49.74

60. Fort Lauderdale: 48.43

Florida small city rankings (out of 133 total)

1. Palm Bay: 66.55

3. Lakeland: 60.19

5. Sunrise: 59.74

6. Boca Raton: 59.38

14. Clearwater: 57.24

18. Davie: 56.59

20. Miramar: 56.51

27. West Palm Beach: 54.77

38. Miami Gardens: 53.47

47. Plantation: 52.53

50. Gainesville: 52.14

54. Coral Springs: 51.95

60. Pompano Beach: 51.14

109. Miami Beach: 41.33

© 2023 Florida Realtors®

Study: Real Estate Hot in Hurricane Ian-Hit Areas

Storms rarely have a long-term effect on the local real estate market. Cape Coral-Fort Myers listings dropped for two months after Ian but rose for the six after that.

FORT MYERS, Fla. – After plunging in the wake of last fall’s Hurricane Ian, home listings in the Cape Coral-Fort Myers metropolitan area have recovered, and sales have begun to bounce back, according to a report from Redfin.

Hurricanes present unique housing market events. Their immediate impact on the local real estate market is harsh, but investors often rush in and the number of real estate transactions bounces back and often increases.

In the two months after the devastating September 2022 storm, Cape Coral-Fort Myers saw 900 fewer new listings than there would have been had the storm not hit, according to Redfin projections. But in the six months after that, the area had 1,314 more new listings than projected, a number that more than offsetting the shortfall.

Put another way, the metro area had a net gain of 415 more new listings.

New listings are likely outperforming expectations due to a backlog created by the storm. Homeowners who paused selling plans or delisted properties in the wake of Hurricane Ian are now putting their homes on the market. There are also probably other homeowners who didn’t intend to sell but are now moving because their home was damaged and/or they want to live in a safer area.

Redfin Senior Economist Sheharyar Bokhari says property insurance prices have gone up, but “homebuyers are still moving to the Sunshine State in search of warm weather and relatively affordable home prices,” though, “ultimately, lower-income residents may be pushed out of the riskiest areas due to rising insurance and rebuilding costs.”

The analysis focuses on home listings, but it’s worth noting that scores of vacant plots have also hit the market in Cape Coral after the homes atop many of those lots were destroyed. There were 6,167 land listings in Cape Coral as of June 16 – comparable with the number of home listings (6,619). Some don’t mention the impact of the storm or the potential for future natural disasters. Other listings do mention Hurricane Ian, and tout the opportunities for builders and homebuyers despite continued storm risk.

While some people who moved to Florida during the pandemic are leaving, new out-of-staters continue to move in, which is incentivizing homebuilders in Cape Coral to keep building, according to local Redfin Premier real estate agent Isabel Arias-Squires.

Florida has doled out 80,000 residential building permits so far this year–more than any other state but Texas. Arias-Squires noted that new-construction homes in Florida have the advantage of being built under the most recent building codes, providing better resistance against natural disasters

Sales bounced back but haven’t fully recovered

In the three months after Hurricane Ian, there were 723 fewer home sales in Cape Coral-Fort Myers than there would have been had the storm not hit, according to Redfin projections. But in the following five months, there were 538 more sales than projected. That means the sales shortfall had shrunk from 723 to 185 by early May 2023.

The home sale recovery suggests that many buyers continue to prioritize waterfront views, relatively affordable home prices and lower taxes more than climate concerns.

Cape Coral-Fort Myers is the seventh most popular migration destination for homebuyers, according to Redfin’s latest ranking. Four other Florida metros – Miami, Tampa, Orlando and North Port – are also in the top 10 as the Sunshine State attracts house hunters from New York, Chicago and other major metros.

Hurricane Ian and home prices

“The storm’s effect on prices was likely muted because at first, new listings fell, which pressured prices to rise due to a shortage of homes for sale.” Bokhari says. “But new listings then more than recovered, which pressured prices to fall because there was more supply than usual.”

© 2023 Florida Realtors®

FHFA: 1Q Home Prices Up 4.3% – but More in Fla.

The Miami area led the nation in price gains with 14.1%, year-to-year, but of 8 Fla. metros included, even the lowest-ranking one (Tampa, No. 36) saw a 5.6% gain.

WASHINGTON – U.S. house prices rose 4.3% between the first quarters of 2022 and 2023, according to the Federal Housing Finance Agency (FHFA) House Price Index (FHFA HPI).

However, year-to-year home prices increases were higher in all eight Florida metros tracked by the study. Six of those were in the top 25 nationally for prices increases, and Tampa, at No. 36, still had a greater year-to-year 1Q price increase the two-thirds of U.S. cities.

Florida year-to-year and quarter-to-quarter rankings in top 100

1. Miami-Miami Beach-Kendall: 14.1% year-to-year, 2.7% quarter-to-quarter

11. North Port-Sarasota-Bradenton: 8.8% YtoY, but down 1.5% QtoQ

14. West Palm Beach-Boca Raton-Boynton Beach: 8.1% YtoY, 0.3% QtoQ

15. Cape Coral-Fort Myers: 8.0% YtoY, 0.6% QtoQ

16. Jacksonville: 7.9% YtoY, 0.8% QtoQ

21. Fort Lauderdale-Pompano Beach-Sunrise: 7.2% YtoY, but down 1.5% QtoQ

33. Orlando-Kissimmee-Sanford: 5.9%, but down 2.2% QtoQ

36. Tampa-St. Petersburg-Clearwater: 5.6: YtoY, 0.7% QtoQ

Quarter-to-quarter, U.S. house prices were up 0.5% in the first quarter. And month-to-month, the seasonally adjusted index found March up 0.6% from February.

“U.S. house prices generally increased modestly in the first quarter” said Dr. Anju Vajja, principal associate director in FHFA’s Division of Research and Statistics, called the price rise modest, but “year over year prices in many western states have started to decline for the first time in over ten years.”

Notable findings

- The U.S. housing market has had positive annual appreciation each quarter since the start of 2012.

- House prices rose in 43 states between the first quarters of 2022 and 2023.

- House prices rose in 78 of the top 100 largest metropolitan areas over the last four quarters. The annual price increase was greatest in Miami-Miami Beach-Kendall at 14.1%. The metropolitan area that experienced the greatest price decline was San Francisco-San Mateo-Redwood City, California, which declined 10.1%.

- Of the seven census divisions with positive house price changes, the South Atlantic division recorded the strongest four-quarter appreciation, posting a 7.2% increase between the first quarters of 2022 and 2023. House prices depreciated in two census divisions: down 2.4% in the Pacific division and 0.1% in the Mountain division.

FHFA releases HPI data and reports quarterly and monthly. The flagship FHFA HPI uses seasonally adjusted, purchase-only data from Fannie Mae and Freddie Mac, covering more than half of all U.S. loans.

© 2023 Florida Realtors®

More S. Fla. Homeowners Gaining Home Equity

The market slowed a bit nationally, but not in S. Fla., which is seeing slower, yet positive home value gains. About 2 out of 3 homeowners (65.3%) are “equity rich.”

MIAMI – Homeowners across South Florida are seeing equity gains in their homes, despite the national housing market slowing down.

About 65.3% of residential properties with a mortgage in South Florida are considered “equity rich,” in the first quarter of this year, according to a report from ATTOM Data, a provider of nationwide property data.

To find how many properties were still building equity, researchers looked at mortgaged residential properties in the area with different levels of loan-to-value ratios. For a property to be “equity rich,” the combined estimated loan amount was no more than 50% of their estimated market value, meaning that the owner had at least 50% equity.

The data shows a steady uptick from the prior two quarters in the tri-county area: For the fourth quarter of 2022, about 64.5% of homes were equity rich, and in the third quarter of 2022, about 63% of homes were equity rich.

Here is a breakdown by county:

South Florida’s continued rise in equity can be attributed to its population growth, as out-of-state buyers have flocked to the area, fleeing larger metropolitan areas with higher housing costs.

“Our population growth is keeping our real estate values up because people are just eating through whatever limited amount of inventory we have left,” said Whitney Dutton with the Dutton Group in downtown Fort Lauderdale. “When they sell their house for a million and see what they can get down here for a million, they say, ‘I’ll take it, since it’s more house than what I am used to. They bump up the resale value of homes.”

On a national level, however, there were small decreases in the amount of homes that could be considered “equity-rich,” the report noted. In the first quarter of 2023, about 47.2% of homes with a mortgage were equity-rich, a slight decrease from the previous quarter when about 48% were equity-rich.

“The equity downturn, small as it was, stood as the latest indicator of how a decline in home prices across much of the country has started to affect homeowners following a decade-long market boom. It comes as home-seller profits have slid to their lowest point in two years,” the report noted.

For South Florida, it’s unlikely that equity gains will decrease as the market is still projected to see increases over the next year.

“We may see a 3-5% bump in property values in the next year, so that will affect equity. We won’t see the double digits we saw over the past few years, but price increases will be more stabilized,” added Dutton. “The southeast of the country is projected to be one of the hottest places in terms of population growth, and people need a place to live. They are going to continue to buy real estate here.”

© 2023 South Florida Sun-Sentinel. Distributed by Tribune Content Agency, LLC.

Floridians Leave Cities for Affordable Housing

As out-of-state and international buyers focused on Miami and other cities, more residents of those cities headed to Fla.’s smaller and more affordable towns.

MIAMI – Florida’s population grew by 416,754 last year, with a whopping 318,855 of those migrating from other states, according to the U.S. Census Bureau. Many of the new residents made a bee-line to major metropolitan areas like Miami-Dade, Tampa and Orlando, adding to congestion and traffic.

But they also helped create a domino effect.

Some already living in Florida’s largest metros said they had enough of the congestion and high costs and looked to move to less crowded areas, like Manatee County.

“We are absolutely seeing that,” said Kristine Smale, senior vice president of Zonda, which provides data and insight to the housing and development industry.

‘Parrish area is absolutely exploding’

Prime areas for Miami residents looking to relocate include Port St. Lucie, Naples, Fort Myers and Bradenton-Sarasota – particularly Lakewood Ranch and Parrish.

“The Parrish area is absolutely exploding. There are more lots under development for housing in the Manatee-Sarasota area than in the Tampa area,” Smale said.

An estimated 37,000 residential lots are under development in the Bradenton-Sarasota area, compared to an estimated 22,000 lots in all of Hillsborough, Pinellas, Pasco and Hernando counties, Smale said.

Factors on the exits from Miami include not only the crowding but some of the highest housing price increases in the United States, Smale said.

Not that Bradenton doesn’t have its own affordable housing issues.

Among Florida cities, only Miami-Dade – the most competitive rental market in the United States – and Orlando, which ranked third on the list, were more competitive than Southwest Florida, which ranks 11th, RentCafe.com, a nationwide apartment search website, reported in January.

In-state migration

Florida was the fastest-growing state in the country in 2022, with a 1.9% population increase, bringing the population to 22,244,823.

Although the rate of increase is not expected to continue indefinitely, the influx of new residents has brought more young people to the state and helped fuel the growth of more high-wage jobs, Smale said.

John Boyd, principal of the Boca Raton-based The Boyd Company, which provides recommendations on corporate site selection, said there are a number of factors contributing to the in-state movement of residents. In Miami, it’s because the area has become one of the least affordable housing markets in the United States, fueled by second-home buyers, the trend of homes being converted into vacation rentals and investment properties, and equity firms buying up housing stock.

In the aftermath of the Surfside condominium collapse in June 2021, the Florida Legislature passed a law requiring condo associations to have sufficient reserve funding to make routine structural inspections and repairs.

Where does money come for condo reserves? Out of the pockets of individual condo owners.

The largest concentration of condos in the state are in Miami-Dade, Broward and Palm Beach counties, Boyd said. Other factors in the cost of living include fast-rising costs for property and auto insurance.

Although Bradenton and Sarasota have not been immune to the same economic headwinds, the cost of living is about 19% cheaper than in the Miami area, Boyd said.

The ‘sweet spot’

The Interstate 75 corridor from Naples to Tampa is an economic “sweet spot,” Boyd said.

Development of Allegiant airline’s Sunseeker Resort in Charlotte Harbor, which suffered millions of dollars of damage from Hurricane Ian, is back on track and will have a powerful impact on Southwest Florida, helping attract more second homebuyers, Boyd said. The resort is expected to open in October.

Other areas in Florida which are attracting residents from more congested cities include Lake Mary, Lake Nona and Gainesville, Boyd said.

The arrival of Brightline train service between Orlando and Boca Raton, Fort Lauderdale and Miami will also help people move from more congested areas, he said. The link to Orlando is expected to open later this year. Having more mass transit, such as Brightline, is appealing to Florida transplants from New York, Massachusetts and other highly populated areas.

“It’s in their DNA,” Boyd said.

While the national economy remains a concern with inflation and high interest rates, the future for Southwest Florida looks bright, he said.

Bradenton benefits from proximity to Tampa

“Tampa has emerged as a major global tech market and is a huge engine of economic activity. Few markets in the United States can compete with what Southwest Florida brings to the table,” he said. “If you are looking for a positive economic indicator, Sarasota Bradenton International Airport is the fastest-growing airport in the country,” Boyd said.

Lakewood Ranch still growing

Lakewood Ranch recently reported that it closed the first quarter of 2023 with 580 sales, a 17% increase over the same quarter in 2022. In March, builders reported 236 sales, which was a 33% increase over the same month in 2022, as well as a 33% gain over February of 2023. The average price was $748,481.

“Florida is still seeing a great deal of in-migration from other states, but more recently, the Ranch has been experiencing increasing moves from within Florida, mostly from high-priced, congested regions,” Laura Cole, senior vice president of LWR Communities, LLC, said in a press release.

Those top Florida feeder markets to Lakewood Ranch include Miami, Tampa and Orlando, she said.

Manatee County grew by 29,420 residents in three years as of July 2, 2022, according to the U.S. Census Bureau estimate. Since 2010, Manatee County has added 106,292 residents with a total of 429,125 people as of the 2022 estimate.

© 2023 Miami Herald. Distributed by Tribune Content Agency, LLC.

Out-of-Town Moves Didn’t End with Pandemic

Number of buyers looking within their metro dropped 15.6% in 1Q, but the number looking elsewhere fell only 4.2%. Fla. has 5 of top 10 want-to-move-to metros.

SEATTLE – The pandemic-era trend of buyers relocating greater distances didn’t end with the pandemic. While Redfin says searches on its website were down overall in the first quarter (1Q) of 2023, the number searching for a home outside their current metro was down only 4.2% compared to a drop of 15.6% of buyers seeking something else near their current location.

During the pandemic, both of those numbers shot up – but the out-of-state mover numbers shot up more.

The reasons for long-distance relocations have changed a bit, though. Many out-of-state moves took place during the pandemic because workers were no longer tied to an office and commute. More recently, a drive for affordable housing has become more important. Relatively affordable places are some of the nation’s most popular destinations.

And of the top 10 move-to cities cited by Redfin for 1Q, five are in Florida.

Looking at the trend another way, house hunters moving to a new area make up a bigger piece of the homebuying pie than ever. A record one-quarter (25.1%) of Redfin.com home searchers looked to relocate to a new metro in the first quarter. That’s up from 22.8% a year earlier and around 18% before the pandemic.

Top 10 move-to U.S. metros, 1Q year-to-year

Popularity is determined by net inflow – how many more users looked to move into an area than leave.

- Miami: Net inflow 8,600 – top origin city, New York City

- Phoenix: Net inflow 7,600 – top origin city, Seattle

- Las Vegas: Net inflow 6,600 – top origin city, Los Angeles

- Tampa: Net inflow 6,000 – top origin city, New York City

- Orlando: Net inflow 5,400 – top origin city, New York City

- Sacramento: Net inflow 5,400 – top origin city, San Francisco

- Cape Coral: Net inflow 4,900 – top origin city, Chicago

- North Port-Sarasota: Net inflow 4,900 – top origin city, Chicago

- Dallas: Net inflow 4,800 – top origin city, Los Angeles

- Houston: Net inflow 4,300 – top origin city, New York City

Things have changed a bit for the top outbound cities, however. While the nation’s largest cities generally saw a population decline during the pandemic, a few are now seeing a better balance between incoming and outgoing residents. Immigration into major U.S. coastal cities like New York and Los Angeles, for example, has rebounded after dropping off drastically in 2020 and 2021.

In many cases, an uptick in international buyers has made up for some of the residents moving to less expensive destinations. The net inflow of immigrants more than doubled from 2021 to 2022 in the Bay Area, New York, Los Angeles, Washington, D.C. and Boston.

“Several years of declining immigration, compounded by Americans flowing out of big coastal cities during the pandemic, resulted in many major coastal cities losing population,” says Redfin Deputy Chief Economist Taylor Marr. “Last year’s immigration rebound was a boon for those cities, which take in most of the people who move to the U.S. from other countries. For the housing and rental markets, the recovery should add enough demand to at least partly make up for the existing residents who move further inland.”

Top 10 move-out U.S. metros, 1Q year-to-year

- San Francisco: Net outflow 31,100 – top destination city, Sacramento

- New York: Net outflow 23,400 – top destination city, Miami

- Los Angeles: Net outflow 20,300 – top destination city, Las Vegas

- Washington, D.C. : Net outflow 18,000 – top destination city, Miami

- Boston: Net outflow 5,800 – top destination city, Miami

- Seattle: Net outflow 4,700 – top destination city, Phoenix

- Chicago: Net outflow 4,500 – top destination city, Cape Coral

- Denver: Net outflow 4,200 – top destination city, Chicago

- Hartford: Net outflow 3,200 – top destination city, Boston

- Minneapolis: Net outflow 2,500 – top destination city, Chicago

Overall, Miami, Phoenix, Las Vegas, Tampa and Orlando were the most popular move-to destinations. Sun Belt locales are typically the most popular because they’re relatively affordable. The typical home in eight of the 10 most popular destinations is less expensive than in its top origin.

People are also moving to the Sun Belt from other countries, and immigration into seven of the 10 most popular migration destinations – Phoenix, Tampa, Orlando, Cape Coral, North Port-Sarasota, Dallas and Houston – more than doubled from 2021 to 2022. However, they still didn’t achieve the total numbers of immigrants as the nation’s big coastal metros.

© 2023 Florida Realtors®

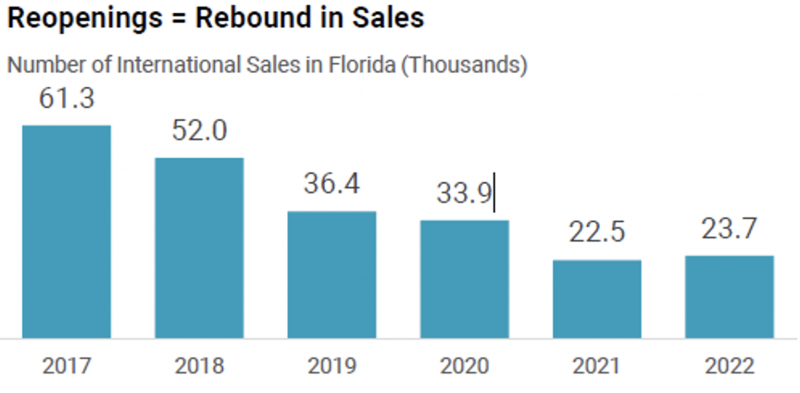

Global Transactions Rebound Despite Challenges

Florida Realtors economist: Florida remains a hotspot for international buyers and sellers, with a slight rebound in activity in 2022. However, constraints remain.

ORLANDO, Fla – A slight rebound in sales activity in 2022 marked progress as the world continues to recover from the pandemic. Exacerbated by the war in Ukraine, supply chain issues continued to drag on the global economy despite a stronger domestic recovery.

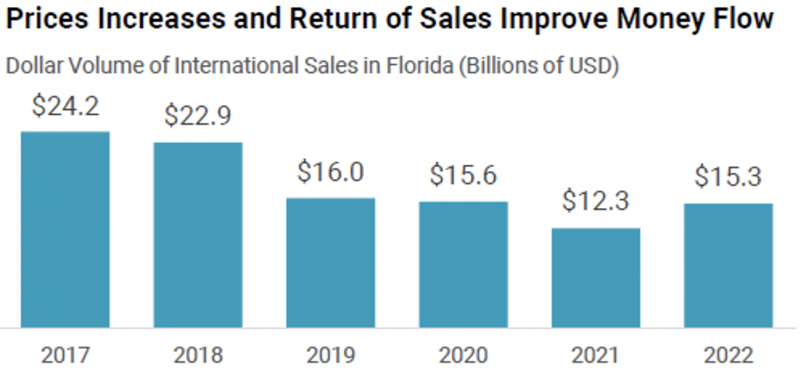

According to Florida Realtors® 2022 Profile of International Residential Transactions in Florida Report, residential purchases (non-commercial) between August 2021 and July 2022 rose 5% compared to the prior 12-month period. The combination of higher sales and rising prices meant dollar volume also increased, reaching $15.3 billion – 20% more than $12.3 billion in 2021.

However, higher sale prices, inflation and lack of inventory continue to constrain the purchase power of buyers of any origin: 49% of respondents cited cost and 38% cited property availability as reasons for not finalizing a deal in 2022.

Florida remains a bargain compared to many other options for international buyers looking to purchase in the United States, but competition for property remains strong and offers few discounts.

Visitors to Florida from abroad – often a precursor to their long-term purchase decision – have been rebounding since travel restrictions evaporated in November 2021. In 2022, 92% of foreign buyers visited Florida before purchasing, up from 89% the year before and back to the historical trend.

South America and Canada continued to lead the pack of international visitors in 2022. These same groups also translate into buyers, with 45% of Florida’s foreign buyers coming from Latin America/Caribbean and 21% coming from Canada.

Despite a slight decline in the number of Canadians transacting in Florida, the value of what they buy is increasing, and it pushed them to the top spot with $1.7 billion in sales in 2022. By comparison, Brazilian buyers, the second largest group, purchased $486 million.

International buyers continue to favor South Florida, with 53% of purchases taking place in the Miami-Fort Lauderdale-West Palm Beach MSA, and the vast majority of those buyers coming from Latin America and the Caribbean. While only 3% of international-buyer purchases took place in the Naples-Immokalee-Marco Island MSA, 51% of them were made by Canadians.

Anyone purchasing Florida real estate in 2022 knew that prices had been rising steadily, but that’s particularly true for foreign buyers. The median sale price among Florida foreign buyers was $462,000 in 2022, increasing $114,700 from 2021’s median price of $347,300.

The median price among foreign buyers was 22% more than the median of all properties sold in Florida between August 2021 and July 2022.

Among buyers from the five countries with the most purchases, Brazilians typically purchased the most expensive properties. The reason for their higher price point of $472,140 was a combination of a preference for detached single-family homes and their focus on more expensive metros, such as the Miami-Fort Lauderdale-West Palm Beach MSA. Argentine buyers also flocked to South Florida, but they tended to purchase condominiums, which generally have a lower price than their detached counterparts. The median purchase price for Argentine buyers was $334,444 in 2022.

Cash is king among foreign buyers, with 69% of their purchases made with all cash compared to 44% for all United States buyers. Cash is most popular among buyers from Canada, Peru and Argentina, while slightly more Brazilian and Columbian buyers take on a U.S. mortgage.

Looking to get into the international buyer game? It’s all about personal contacts and referrals, as 32% and 21% of business came from those two sources respectively. Location is also a major factor, as 42% of respondents cite location as the prime reason for their purchase. For others, profitability and security of investments is what clinches the deal. Know your market and what buyers are looking for to appeal to their needs.

The 2022 Profile of International Residential Transactions in Florida report presents information from Florida Realtors members regarding residential transactions with international clients closed during the 12-month period of August 2021–July 2022. This annual survey and report is conducted to assess international investment trends in Florida residential real estate, including sales volume, characteristics of foreign buyers, and challenges and opportunities inherent in cross-border transactions.

Jennifer Warner is an economist and Florida Realtors Director of Economic Development

© 2023 Florida Realtors®

Why Does It Still Feel Like a Seller’s Market?

RE usually sees cycles between buyer’s and seller’s markets, but this time it’s a bit different. Supply vs. demand hasn’t changed because both sides pulled back.

SEATTLE – New listings fell 21.8% year-to-year during the four weeks ending April 2, one of the biggest drops since the start of the pandemic, according to a Redfin study.

An increasing number of homeowners don’t want to move because they still have generational-low mortgage rates secured only a few years ago. While rates have fallen for four weeks in a row, according to this week’s report, they’re still about twice as high as they were before 2021.

As a result, buyers unafraid of current mortgage rates quickly scoop up new listings. Of homes going under contract, nearly half are doing so within two weeks; at the beginning of 2023, it was about 25%.

“Elevated mortgage rates are perhaps an even bigger deterrent for would-be sellers than for would-be buyers,” says Redfin Deputy Chief Economist Taylor Marr. “Giving up a 3% mortgage rate for one in the 6% range is a tough pill to swallow. Today’s serious homebuyers have grown accustomed to the idea of a 5% or 6% rate and have adjusted their budgets accordingly.”

“Shiny new listings are getting multiple offers and selling fast. The caveat is that they have to be priced correctly from the beginning,” says Denver Redfin agent Stephanie Collins. “One of my buyers recently made an offer on a move-in ready home in a popular area. The home was priced right in line with the market at $520,000; it received eight offers and went for $560,000 to a competing buyer.”

Florida ranks near top for rising home prices

In cities where buyer demand outpaces seller supply, home prices continue to go up – and Florida is home to three of the top five U.S. cities for price increases.

While Milwaukee led the nation for price increases (up 11.4% year-to-year), Fort Lauderdale came in second (up 8.9%), followed by West Palm Beach (up 8.2%), Miami (up 7.9%) and Columbus, Ohio (up 6.3%).

On the flipside, the top five price declines in the U.S. were largely on the West Coast: Home prices dropped in 28 of the U.S.’s 50 most populous metros, with the biggest drop in Austin, Texas (down 14.7% year-to-year), Sacramento (down 11.7%), Oakland, California (down 10.4%), San Jose (down 10.2%) and Seattle (down 9.6%).

© 2023 Florida Realtors®

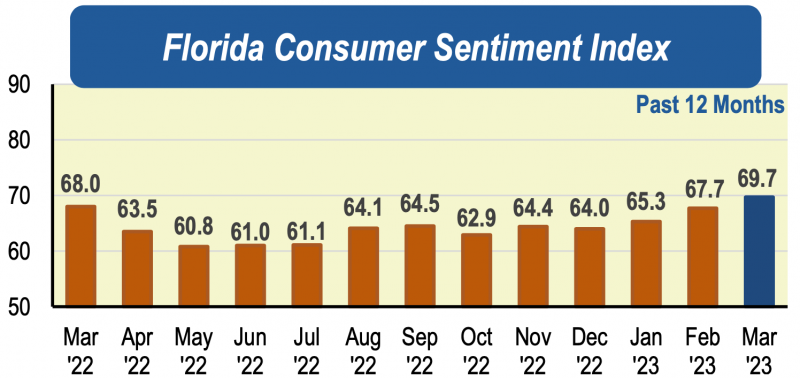

Fla.’s Confidence Index Up – 3rd Month in a Row

Banking sector chaos and a see-sawing stock market didn’t deeply impact Floridians. UF’s sentiment index for March rose 2 points, surprising UF economists.

GAINESVILLE, Fla. – Consumer sentiment in Florida increased for a third month in a row in March to 69.7, up 2 points from a revised figure of 67.7 in February. On the contrary, a similar national sentiment study found a 5-point drop.

“Considering the chaos in the banking sector in mid-March – which saw the largest bank failure since the 2008 financial crisis – the positive change in consumer attitudes among Floridians in March comes as a surprise,” says Hector H. Sandoval, director of the Economic Analysis Program at the University of Florida’s (UF) Bureau of Economic and Business Research.

“Despite some speculation that the Federal Reserve would halt rate hikes in response to the recent string of bank failures, the Fed officials decided to continue raising interest rates in their latest meeting as inflation remains high and the labor market is still tight,” he added.

Among the five components that make up the index, four increased and one decreased.

Current economic conditions: Views of personal financial situations now compared with a year ago increased 2.1 points, from 58.6 to 60.7 – and those views were shared by Floridians across all sociodemographic groups, despite still-present inflation.

However, opinions on whether it’s a good time to purchase a major household item like an appliance fell slightly by three-tenths of a point, from 57.9 to 57.6.

Future economic expectations: Personal financial expectations a year from now went up 2.3 points, from 81.5 to 83.8. Expectations about U.S. economic conditions over the next year also rose, going up 2.1 points from 67.6 to 69.7.

But the outlook for U.S. economic conditions over the next five years showed the greatest increase in March, up 3.7 points from 73 to 76.7. It was a positive view shared by all Floridians except those with an annual income under $50,000.

February job gains remained solid. The unemployment rate in Florida held steady at 2.6%, while the national increased slightly to 3.6%. First-time unemployment claims in Florida continued to decline, reaching their lowest level since December. Over the year, the state gained 427,400 non-agricultural jobs, with all 10 major industries experiencing positive gains. The leisure and hospitality industry saw the largest increase in employment.

“The latest data clearly indicates that the labor market remains unusually tight. When combined with the persistently high inflation rate, it strongly suggests that the Federal Reserve will continue to raise interest rates in the coming months,” says Sandoval.

However, Sandoval predicts a future decline in Floridian consumer sentiment.

“Over the past 12 months, the Fed has increased interest rates more than at any time since the early 1980s,” he says. “Moreover, the recent turmoil in the banking sector might have dented economic growth and increased the risk of a recession as financial institutions are likely to become more cautious in their lending. As a result, we anticipate that consumer sentiment in Florida will remain at its low levels for some time to come.”

The index used by UF researchers is benchmarked to 1966, which means a value of 100 represents the same level of confidence for that year. The lowest index possible is a 2, the highest is 150.

© 2023 Florida Realtors®

Why Is Fla. America’s Fastest-Growing State?

April 3, 2023

The Census Bureau says Fla. is now the nation’s fastest growing state, a rank it hasn’t held since 1957. Why? Taxes often get some credit, but it’s mainly the sunshine.

WASHINGTON – Florida is the fastest-growing state in America for the first time since 1957, according to the U.S. Census Bureau. The population in the southeastern state, which is known for its warm weather and sandy beaches, now tops 22 million.

“I hate being cold,” says Kathy Bonini, 42, who grew up in Pennsylvania but moved to Florida in 2011. “Everybody loves sunshine and palm trees.”

Nancy Sikes-Kline, mayor of the Florida port city of St. Augustine, agrees.

“You know, we call ourselves ‘the sunshine state’ and I think that that makes a big difference,” Sikes-Kline says when asked why people relocate to her state. “I think, at the very core, it’s just this wonderful weather that we have. The sunshine.”

Florida is known for attracting older, retired Americans. But more than 700,000 people of all ages moved to the state between April 1, 2020, and July 1, 2022. That was during the COVID-19 pandemic, a time when many remote workers could live wherever they wanted.

Economist Sean Snaith says there are factors other than the weather that draw people to Florida, including a robust labor market and the fact that, unlike most U.S. states, Florida has no state income tax.

“Depending on where folks are moving from, that might be an extra 8, 9, 10% of your pay that you get to keep that previously went to pay state taxes or other local taxes,” says Snaith, an economics professor at the University of Central Florida and director of UCF’s Institute for Economic Forecasting.

An analysis of Census data shows that people within the United States who move to Florida most frequently come from New York, Georgia, Ohio, Pennsylvania and California.

“Time to kind of get out of California with the wildfires and the high cost of living,” says Florida resident Aaron Dan, 36, who moved from the West Coast in May 2021, during the pandemic. Dan, who works in real estate, sees more opportunities for land development and commercial leasing in Florida. “You can get a lot more for your dollar around here, lower taxes, obviously,” he says. So, I think just the cost of living is very attractive as well as the opportunity for growth.”

Even before the pandemic, nearly two-thirds of the people who lived in Florida came from out of state. One-fifth of those transplants relocated from a foreign country.

“We’ve had a lot of international in-migration to the state from a variety of locations. You know, it’s not just one or two countries, it’s Central America and South America, the Caribbean,” Snaith says. “People want to move to the United States, in general, and Florida tends to get a larger chunk of those immigrants.”

But population growth can make life in the Sunshine State more expensive. The average price of a home in Florida rose 14% in the past year, compared with the national average of 8.7%, according to Zillow, a real estate marketplace company.

“Florida is kind of a cheap place to buy a house and to live. That’s become less the case,” Snaith says. “So that is making life difficult in terms of affordability. And that’s one of the problems that Florida is going to be grappling with here, I think, for some time to come.”

Realtor Sharon Wooten is a Florida native. Over time, she’s seen orange groves give way to housing developments.

“It’s changed a lot. The farmland is gone. I think if we take care of our natural resources, and we don’t grow too fast, it’s OK. And, I think, if we are choosy about what comes in. A lot of these developments are very, very nice and they take care of these developments and everything they do is top notch,” she says. “As long as it’s good growth, it’s OK. You know, it’s brought in a lot of opportunities for people in this area that they may not have ever had.”

Wooten says the increased development has had a positive impact on daily life for some.

“My mother and my grandmother have had opportunities to shop and go to plays and restaurants and things that they didn’t have before,” she says. “So, it’s just sort of opened up a new world to them.”

Snaith says that, as far as the economy is concerned, population growth is “nothing but good news.”

“Every new household that moves to Florida needs a place to live, they need food, they need medical care, their children, if they have them, need schooling, and they clothe them. They need all the things that consumers buy,” Snaith says. “So, you know, population growth is one side of the coin. The flip side of that same coin is economic growth. … The more people you have in any regional economy, the more economic activity they will generate.”

Florida is the third-most-populous state in the country. People have been moving there since the 1950s, when air-conditioning first became commonplace, and that influx shows no signs of letting up.

“Unless there’s some sort of a dramatic change to, you know, the environment, politically, economically,” Snaith says, “I just don’t see any kind of factor that would take us off this course that the state’s been on for a long time.”

Copyright © 2023 Federal Information & News Dispatch, Inc.

Falling Mortgage Rates Add Fuel to Housing Recovery

Mortgage rates continued to slide this week, adding more fuel to what appears to be a recovering housing market. The 30-year fixed-rate mortgage averaged 6.32% for the week ending March 30, Freddie Mac reported Thursday. Borrowing costs are heading down as major housing indicators, such as existing-home sales, new-home construction and contract signings for home purchases, have been on the rise for the past three months.

“Although there was some calming in the market after the recent bank shock, mortgage rates continued to drop,” says Nadia Evangelou, senior economist and director of real estate research for the National Association of REALTORS®. “Thus, buyers were able to lock in a lower rate by the end of the first quarter.”

The people most affected by shifts in mortgage rates may be baby boomers, who have edged out millennials as the top homebuying force in America, according to NAR’s recent 2023 Home Buyers and Sellers Generational Trends Report. “This demographic shift is bound to be observed in the real estate market for the next decade,” Evangelou says. “About 20 million additional households will be older than 65 by 2030. With nearly 80% of them owning their home, baby boomers have substantially more wealth than younger generations.”

But limited housing options likely will hold some would-be buyers back this spring, says Sam Khater, Freddie Mac’s chief economist. “Over the last several weeks, declining rates have brought borrowers back to the market,” he says. “But as the spring homebuying season gets underway, low inventory remains a key challenge for prospective buyers.”

Freddie Mac reported the following national averages with mortgage rates for the week ending March 30:

- 30-year fixed-rate mortgages: averaged 6.32%, down from last week’s 6.42% average. Last year at this time, 30-year rates averaged 4.67%.

- 15-year fixed-rate mortgages: averaged 5.56%, also down from last week’s 5.68% average. A year ago, 15-year rates averaged 3.83%.

Articles written by REALTOR® Magazine staff.

Study: High Number of Buyers Still Move State-to-State

In Feb., the number of buyers searching listings outside their state dropped 3.6% year-to-year – but those looking locally fell 14.4%. 5 Fla. metros are top go-to spots.

SEATTLE – The number of home searchers looking to relocate to a new metro fell 3.6% year-to-year in February, according to a report from Redfin – but that’s less than a 14.4% drop looking to relocate within their current metro. And once again, Florida and other Sun Belt states sparked the most interest.

Rising mortgage rates dented buyer demand in general, but it’s had little impact on where buyers wish to move. In some cases, buyers moving from high-cost metros, such as the San Francisco Bay area, can compensate for higher interest rates by buying a home in less costly metro areas, such as many in Florida. High rates don’t impact those buyers as much because they’re getting a cheaper house and possibly pocketing some proceeds from a home sale in a more expensive area.

Additionally, some relocating homebuyers have a non-negotiable reason for their move, such as a better job or to be closer to family. High rates are less likely to deter those buyers than ones simply considering a different house within the same town.

Buyers moving to a new metro

Of the buyers nationwide seeking a home, one in four (25.1%) looked to relocate to a new metro in February. A year earlier, it was 22.9%. Before the pandemic, it was roughly 18%.

For state-to-state movers, five of the top 10 go-to destinations are in Florida.

Top 10 go-to metro areas

- Miami

- Phoenix

- Las Vegas

- Sacramento, California

- Tampa

- Orlando

- Cape Coral

- Dallas

- North Port-Sarasota

- Houston

Popularity is determined by net inflow – how many home shoppers looked to move into an area rather than out of that area.

The typical home in popular go-to destinations is less expensive than the typical home they want to leave behind. The typical Miami home sold for $485,000 in February, for example, compared with $640,000 in New York, the most common origin for its incoming homebuyers.

Top 10 move-out metro areas

- San Francisco

- New York

- Los Angeles

- Washington, D.C.

- Chicago

- Boston

- Seattle

- Denver

- Hartford

- Portland

© 2023 Florida Realtors®

SW Fla. Doing Fine After Hurricane and Pandemic

CEO of Sage Communities: “Who ever thought that a devastating hurricane would cause a real estate boom?” Ian’s hardest-hit barrier islands are now hot spots.

FORT MYERS, Fla. – The future of Southwest Florida real estate looks bright, three high-profile area real estate experts say, but just how bright depends on several factors few of us have any control over: percentages, pricing and politics.

Randy Thibaut, founder of LSI Companies and CEO of Sage Communities likes to call them the three “Ps.” Percentages refers to interest rates. Pricing is the cost of real estate, politics refers to the volatile political climate in the state and nationally.

There’s a fourth “P” that is under our control: perspective.

Thibaut and Denny Grimes, residential real estate expert and president of Denny Grimes & Team at Keller Williams Realty, along with Justin Thibaut, Randy’s son and CEO of LSI Companies, all presented the facts and their perspectives on what the three “P”s might or not bring us, as we emerge from the COVID pandemic and navigate a way forward from probably the biggest natural weather disaster Southwest Florida has ever faced – Hurricane Ian.

No wonder the path is uncertain. What is certain is the resiliency of the residents of Southwest Florida and the resolve to move through it.

That’s why the theme of their event Market Trends, held recently before a sold-out crowd at the Caloosa Sound Convention Center in Fort Myers, was called “The Future Ain’t What It Used to Be.”

“You would think the pandemic and hurricane would devastate the market. It didn’t,” Randy Thibaut said. In COVID, people locked down, but Florida had an “open for business policy,” and the opportunity to escape more stringent restrictions elsewhere, he said.

Businesses using Zoom to communicate with employees confined to their homes meant you were no longer tied to your desk to do your job, Grimes said. Those who already planned to retire to Southwest Florida just decided to make the move earlier.

When talking about the housing market, “The elephant in the room is obviously Hurricane Ian,” Thibaut said. “Who ever thought that a devastating hurricane would cause a real estate boom?” In areas hurt the most – that is, the barrier islands – is where the real estate market is hottest, he said.

“Vulture buyers” swooped in immediately after the hurricane to buy up what’s left, he said. “Now the vultures are in a feeding frenzy,” and are continuing to pay significantly more for properties, he said. He doesn’t see the frenzy stopping anytime soon.

“Who could imagine a clean slate in Fort Myers Beach?” Thibaut asked. “The sky’s the limit.”

He sees Fort Myers Beach undergoing a kind of “renaissance and rebirth” and being rebuilt as an upscale community, bringing in a whole new demographic. “There are many people who love Fort Myers Beach and don’t want it to change. But it has to change because it has to be rebuilt,” he said. “Some owners are saying, ‘I’m never going to sell,’” he said. “That’s because they haven’t received the (right) offer yet.”

The scenario is multi-million-dollar condos, Thibaut said. The question is whether the local town government at the beach can handle it. “Are they able to handle the tidal wave coming this way?” They may need to ask Lee County for help, he said. “This is not for amateurs.”

Sanibel and Captiva islands are facing the same tidal wave, but on an even higher level, he said. People are buying properties that weren’t even damaged to redevelop them, he said. “There are opportunities galore for custom builders.”

Meanwhile, “Developers and builders are pounding their fists” and wanting building permits,” he said. The county staff have done a remarkable job, processing a whopping 35,000 permits since Ian, he said. Those permits were mostly for hurricane repair.

But builders and contractors are also on the fence as conditions are more uncertain. Interest rates are hovering around 7%. “There’s a big difference when you go from 3.5% to 7%,” he said. Buyers get priced out of the market. Those who already bought at 3.5% are holding on to what they have because now the rates are 7%.

Then there’s the turmoil of the political climate.

“I’m pretty confident when these three align (percentages, price and politics), we’ll go from a normal market to a bat-shit crazy market.”

Grimes presented statistics that show the residential real estate market has already been pretty crazy.

For example, when the housing bubble burst in 2009, the median sale price for an existing single family home in Lee County was $89,000. That price rose 180% to $249,000 in 2019. Since then, the price has risen another 67% to $416,000 at the end of 2022. Since the bubble burst in 2009 the price has gone up more than 340%. Currently, the median sale price in Lee County is $430,000, he said.

At the end of 2022, the median price for a single-family home in Lee was $416,250; in Collier County, $775,000 and in Charlotte County, $389,450.

Grimes said he hypothesized that the market would suffer more in Hurricane Ian than the rest of the state, but Lee and Collier counties actually outperformed the rest of the state, he said.

And the mantra is no longer location, location, location, he said. It is availability and higher ground. The best-selling communities in 2022 were Babcock Ranch and Ave Maria.

Last year, mortgage rates doubled in one year, Grimes said. He believes interest rates will go higher before they go lower. Even when they lower, no one should ever expect to see a 3% interest rate again. It’s still a seller’s market, but no longer at the level where a seller would tell a buyer “Jump” and the buyer would say, “How high?” he said.

“The best time to buy is when sellers fear tomorrow be will worse than today,” he said.